Retroactive Tax Credits 2024 Calendar Date – If you weren’t able to do so last year, don’t fret — there’s still time to max out your 2023 contributions in 2024. Tax Day is the deadline for filing federal income tax returns, so it’s not a day . Flipping the calendar from 2023 to 2024 will bring it will start accepting tax returns next year, but it’s usually around the last week of January. The start date last year was Jan. 23. .

Retroactive Tax Credits 2024 Calendar Date

Source : www.shrm.org

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

are tax refunds delayed 2024|TikTok Search

Source : www.tiktok.com

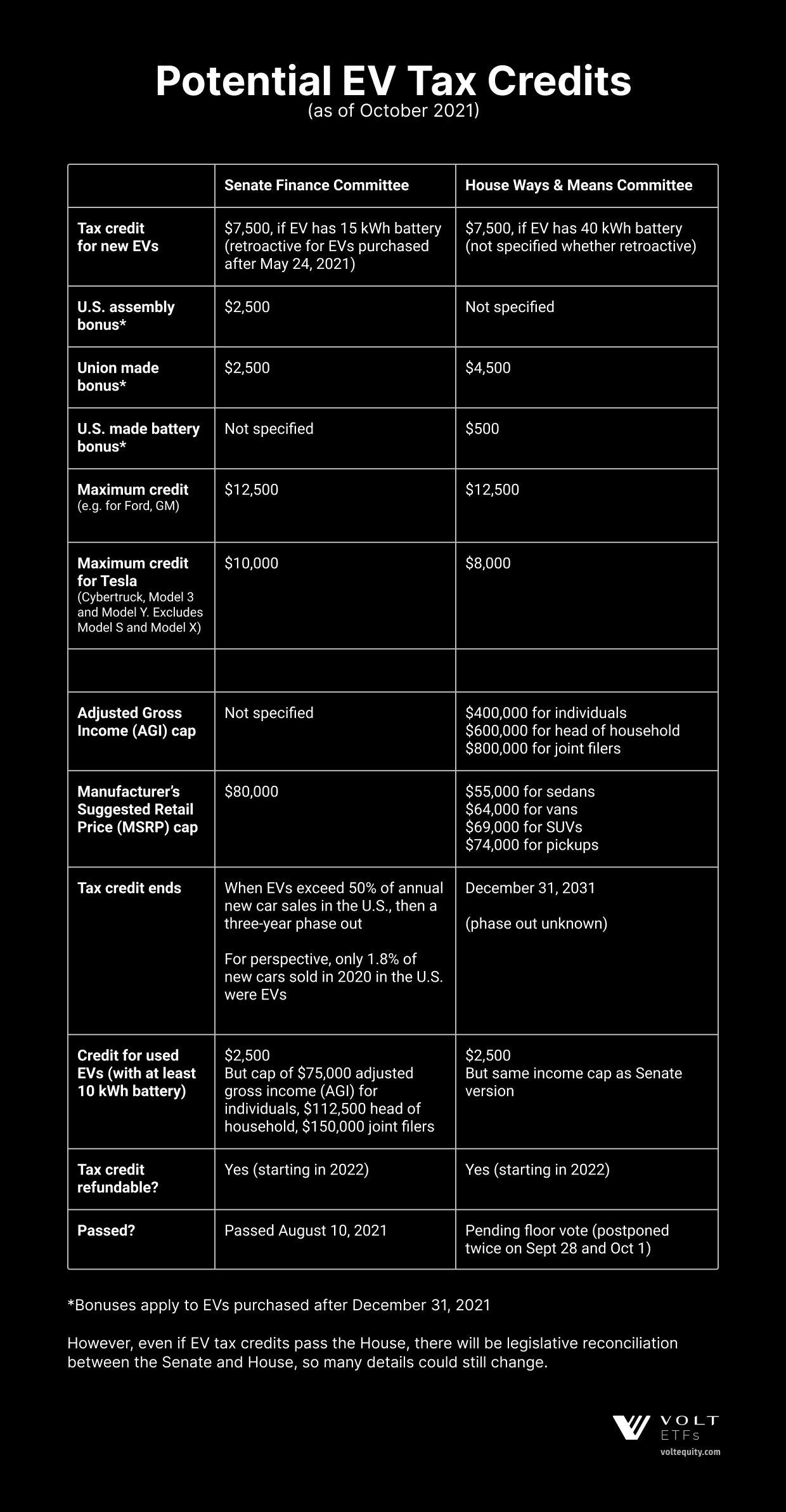

The Tesla EV Tax Credit

Source : www.voltequity.com

ICYMI | Current Developments in California, Florida, Indiana, and

Source : www.cpajournal.com

Amazon.com: Retrospect Group, Vintage Maps 2024 Wall Calendar

Source : www.amazon.com

Novogradac Journal of Tax Credits | Novogradac

Source : www.novoco.com

Can You Still Claim the Employee Retention Credit (ERC)?

Source : www.investopedia.com

Gibson CPA, LLC | Allen TX

Source : www.facebook.com

2024 Guide to Employee Retention Credit KatzAbosch

Source : www.katzabosch.com

Retroactive Tax Credits 2024 Calendar Date Retroactive Filing for Employee Retention Tax Credit Is Ongoing : For taxpayers living in Maine or Massachusetts, you have until April 17, 2024, due to the Patriots and Emancipation Day holidays. If a taxpayer resides in a federally declared disaster area, they also . Due Date For 2024 Last Quarterly Payment The due date for the last quarterly payment of 2024 is January 15, 2025. Make sure to mark this date on your calendar qualify for tax credits related .

:max_bytes(150000):strip_icc()/Employee-retention-credit-25270655c72840d5ab9012169ef9e21d.jpg)