Child Care Tax Credit 2024 Schedule – The proposed deal would increase the maximum refundable amount per child to $1,800 in tax year 2023, $1,900 in tax year 2024, and $2,000 in tax year 2025. Additionally, the maximum $2,000 child tax . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Child Care Tax Credit 2024 Schedule

Source : twitter.com

Claiming Child Care Expenses in 2023 and 2024: Tax Relief for Families

Source : kxan.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

2023 2024 Child Tax Credit: What Will You Receive? | SmartAsset

Source : smartasset.com

Rep. Arvind Venkat on X: “The expanded child and dependent care

Source : mobile.twitter.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Durst & Associates Financial Services

Source : www.facebook.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Rep. Mike Sturla on X: “To utilize the expanded Child & Dependent

Source : twitter.com

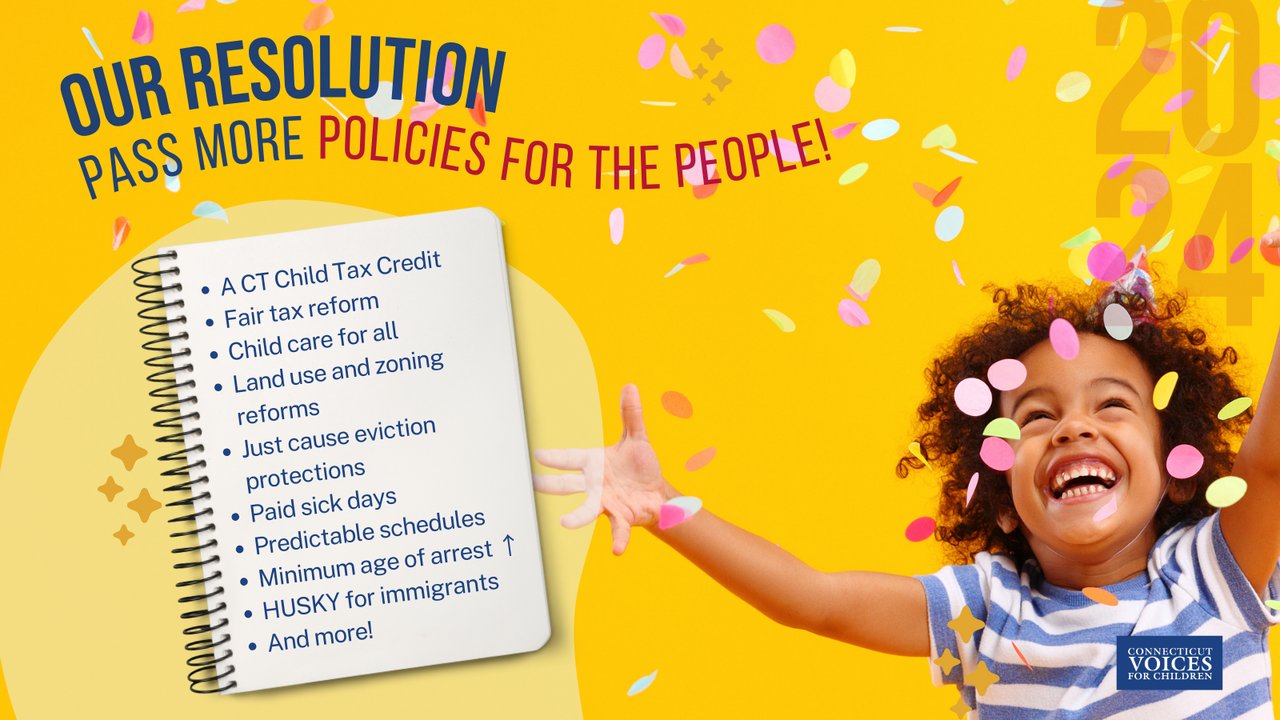

Child Care Tax Credit 2024 Schedule CT Voices for Children on X: “Happy New Year! Want to know our : Under the proposed legislation, the child tax credit would increase the maximum refundable child tax credit to $1,800 for 2023 tax returns, $1,900 for the following year, and $2,000 for 2025 tax . A proposal that would provide tax breaks to businesses that operate child-care facilities for employees got support Monday in the House. The bill (HB 635) also would give tax credits to businesses .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)